CARES Act Update and Explanation

Learn how the CARES Act (Coronavirus Aid, Relief and Economy Security Act), can empower you to support nonprofits during COVID-19 with its new, financially beneficial tax laws. The impact of this pandemic is affecting many of our seniors, children and low-income families. Read below our summaries of the CARES Act. As always, please consult your personal tax professional.

$300 Above-the-Line Deduction (Must Take Standard Deduction)

If you take the standard deduction on your 2020 tax return (the one that you’ll file in 2021), you can claim a brand new “above-the-line” deduction of up to $300 for cash donations to charity you make this year. Donations to donor advised funds and certain organizations that support charities are not deductible. Normally, you have to itemize on Schedule A to get a tax break for charitable donations. However, in this case it’s the other way around–if you itemize, you can’t take this new deduction.

60% of AGI Limit Waived (Must Itemize)

If you itemize on Schedule A of your tax return, you can claim a deduction for your charitable donations. However, the amount you can deduct for cash contributions is generally limited to 60% of your adjusted gross income (AGI). Any cash donations over that amount can be carried over for up to five years and deducted later.

The CARES Act lifts the 60% of AGI limit for cash donations made in 2020 (although there’s still a 100% of AGI limit on all charitable contributions). That means itemizers can deduct more of their charitable cash contributions this year, which will hopefully boost charitable giving. As with the new above-the-line deduction, donations to donor advised funds and supporting organizations don’t count.

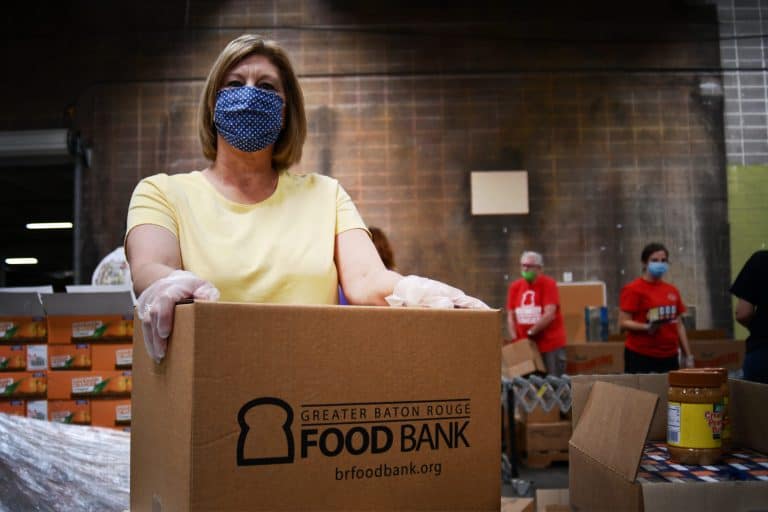

Click here if you would like to donate to support our mission of feeding the hungry. Your donation of only $1 could help provide up to 3 meals. Remember to consult your personal tax professional. If you have any additional questions, please contact the Food Bank at 225-359-9940 or email info@brfoodbank.org.